Plastic monies and mobile wallets have transformed the process of payment systems, globally. Electronic Data Interchange (EDI) and the e-commerce payment systems have also become increasingly popular due to the widespread use of the internet-based shopping and banking. Consumers across the globe are discovering how easy, quick, and convenient it can be to use contactless cards, as well as mobiles and wristbands for everyday transactions. A contactless transaction can be up to twice as fast as a traditional card transaction, and unsurprisingly many more folds faster than using cash; they translate into shorter queues and lesser hassles for both consumers and merchants.

The evolving technologies, and the pervasion of crypto currencies such as Bitcoin payments into e-commerce website has avoided exchange rate fluctuations. Eliminating the issues of chargeback and fraud, Bitcoin payments give access to international

markets, along with several other advantages over traditional payment networks. Additionally, this cheaper alternative for accepting payments online does not need to comply with PCI-DSS and does not require any rolling reserve.

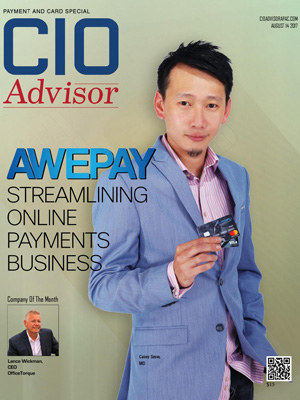

In this edition of CIO Advisor, our editorial team has sieved a large number of companies across this industry, and handpicked, whose solutions and services enable the enterprises to combat their business challenges. We present you “Top 10 APAC Payment Solution Companies 2017”. The organizations featured are chosen on the basis of their comprehensive range of offerings, their efficiency in delivering satiable services, and their exceptional contributions to this space. The aim of this proposed list is to help enterprises find befitting payment and card solution providers that can devise strategies and enable the enterprises achieve their desired business outcome.